Creating a tax

The current version of the platform does not apply to charges taxes created in the Taxes section. You can only add taxes to charges within the Postpay model using API (see Add taxes). To inform customers about whether taxes are included in their payments and orders or not, you may use UI templates (see Configuring UI templates)

To create a tax:

- Go to Taxes (see Navigation). The list of taxes is displayed (see Viewing the list of taxes).

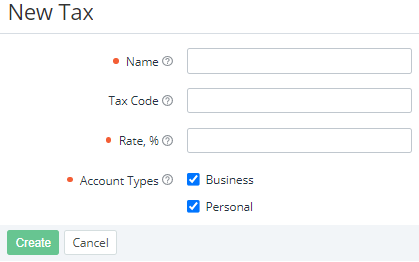

- Click Create Tax. The New Tax page is displayed.

- In the Name field, enter the tax name to be displayed in orders, payments, and invoices.

- Optionally, in the Tax Code field, enter the tax code that can be displayed in PDF receipts of payments and invoices.

- In the Rate, % field, enter a number — the tax rate percentage. The tax rate can be 0 and have up to two decimal places.

- In the Account Types group, leave the checkboxes selected for account types for which the tax must apply. By default, all account types are selected.

- Click Create. The tax is created and displayed in the list of taxes. The created tax is also delegated to all downstream resellers as read-only.