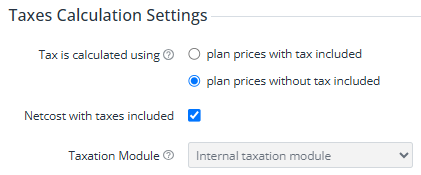

Taxes calculation settings

To configure the tax calculation settings:

- Go to System Settings (see Navigation). The System Settings page is displayed (see System settings).

- Go to the Taxation tab.

In the Tax is calculated using group, select how the platform applies taxes (see Managing taxes) to prices in plans:

If you change the tax calculation settings for a reseller with accounts and subscriptions, make sure the prices in plans are specified correctly (see Managing plans). Otherwise, after saving the changes, payments for accounts may be generated wrongfully.

- Plan prices without tax included — if all prices in plans do not include taxes (by default):

- The charge amount without taxes is calculated as follows:

ChargeAmountWithoutTax = Duration × Quantity × Price × (CurrencyRate / CurrencyUnit), whereCurrencyRateandCurrencyUnitare used if the plan currency differs from the reseller currency (see Managing currency rates). - The amount of every tax is calculated as follows:

TaxAmount = ChargeAmountWithoiutTax × TaxRate / 100, whereTaxRateis the tax rate percentage (see Viewing the list of taxes). - The sum of all taxes for a charge is calculated as follows:

TaxesAmount = TaxAmount1 + TaxAmount2 + ... + TaxAmountN. - The charge amount with taxes is calculated as follows:

ChargeAmount = ChargeAmountWithoiutTax + TaxesAmount. - During the order configuration, all prices, except for the order total, are displayed without taxes.

- The charge amount without taxes is calculated as follows:

- Plan prices with tax included — if all prices in plans include taxes:

- The charge amount with taxes is calculated as follows:

ChargeAmount = Duration × Quantity × Price × (CurrencyRate / CurrencyUnit), whereCurrencyRateandCurrencyUnitare used if the plan currency differs from the reseller currency (see Managing currency rates). - The sum of all taxes for a charge is calculated as follows:

TaxesAmount = ChargeAmount - ChargeAmount / (1 + TaxRate1 / 100 + TaxRate2 / 100 + ... + TaxRateN / 100), whereTaxRate1 ... TaxRateNare the tax rate percentages (see Viewing the list of taxes). - The charge amount without taxes is calculated as follows:

ChargeAmountWithoutTax = ChargeAmount - TaxesAmount. - The amount of every tax is calculated as follows:

TaxAmount = ChargeAmountWithoiutTax × TaxRate / 100, whereTaxRateis the tax rate percentage (see Viewing the list of taxes). - During the order configuration, all prices are displayed with taxes.

- The charge amount with taxes is calculated as follows:

- Plan prices without tax included — if all prices in plans do not include taxes (by default):

- Using the Netcost with taxes included checkbox, select whether the charge net cost should be calculated considering taxes similar to the charge amount or without them. By default, the checkbox is selected.

- Skip selecting the taxation module. The current version of the platform supports only the internal taxation module.

- Click Update to save the changes.