Viewing details of the invoice for the Postpay charging model

To view the details of an invoice for the Postpay model:

- Go to Invoices (see Navigation). The list of invoices is displayed (see Viewing the list of invoices).

If it is necessary, filter the list of invoices by account type. The filter is available, but the corresponding column is absent in the list.

- Click the ID or number of the required invoice with Payment model = Postpay. The invoice details page is displayed. The page includes the following groups:

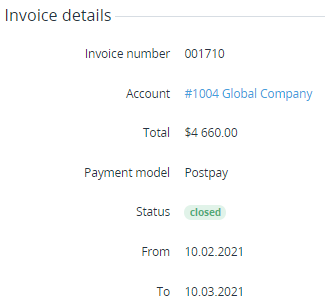

Invoice details

In the Invoice details group:

- Invoice number — the number of the invoice. The invoice number format can be configured in the system settings (see General system settings).

- Account — the name of the account to which the invoice is issued.

- Total — the amount of the invoice in the platform in the reseller currency, taking into account the charges and corrections. Total does not depend on External total.

- External total — if managing invoices for the Postpay model by a third-party ERP system is activated (see Managing invoices for the Postpay model by a third-party ERP system), may display the amount and currency of a third-party invoice after the invoice approval. See also Viewing payment details.

- Approval date — displayed if managing invoices for the Postpay model by a third-party ERP system is activated (see Managing invoices for the Postpay model by a third-party ERP system), and the invoice is approved.

- Payment model — Postpay.

- Status:

- Open — the invoice is created, but not yet issued to an account because the billing period is not ended.

- Closed — the invoice is closed. Invoices are closed on the second day of the next billing period. Closed invoices are issued to accounts.

- From — a billing day with the start date of the covered period.

- To — a billing day with end date of the covered period.

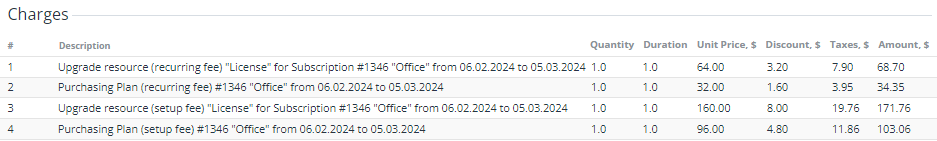

Charges

Charges — a table with the list of charges included in the invoice:

- # — the serial number of a charge in the invoice.

- Description — the detailed information about a charge.

- Quantity — the quantity of the service or resource units (up to three decimal places).

- Duration — the covered period in months (except for subscription to plans with the Pay as you go (external) billing type).

- Unit price — the unit price of a service or resource (except for subscription to plans with the Pay as you go (external) billing type).

- Discount — the amount of the applied discount (see Managing discounts).

- Taxes — the amount of taxes applied to a charge when it was created (see Managing taxes).

- Amount — the amount of a charge.

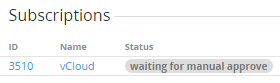

Subscriptions

Subscriptions — a table with the list of subscriptions that have charges closed during the previous billing period:

- ID — the unique identification number of a subscription.

- Name — the name of a subscription.

Status — the current status of a subscription.

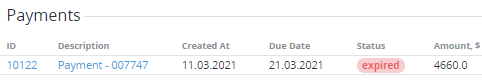

Payments

Payments — a table with the list of payments linked to the invoice. Payments are displayed only after the invoice gets the Closed status. The table includes the following information:

- ID — the unique identification number of a payment.

- Description — the description of a payment with its number in the platform (see General system settings).

- Created at — the date of the payment creation.

- Due date — the latest date for completing a payment. On the next day, if not completed, it gets the Expired status (see Payment for rendered services).

Status — the current status of a payment (see Payment types).

- Amount — the amount of a payment, taking into account the corrections.

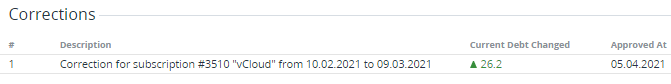

Correction

Correction — table with the list of corrections (see Managing corrections) included in the invoice (if any) that contains the following columns:

- # — the serial number of a correction in the invoice.

- Description — the detailed information about a correction.

- Current Debt Changed — the amount of a correction:

- The down-pointing triangle ▼ and the "-" sign are displayed if a negative correction is created (the current debt is reduced using the correction).

- The up-pointing triangle ▲ is displayed if a positive correction is created (the current debt is increased using the correction).

- Approved at — the date and time when a correction is approved by a manager.

Taxes

Taxes — a table with the list of taxes. The table is displayed, if a manager added at least one tax for a charge included in the invoice (for details, see Adding taxes for Charges in Postpay model):

- # — the serial number of a tax in the invoice.

- Name — the tax name.

- Description — the tax description and additional information.

- Amount — the tax amount. A negative tax value is a refund, and it is deducted from the charge amount. A positive total tax value is added to the charge amount.